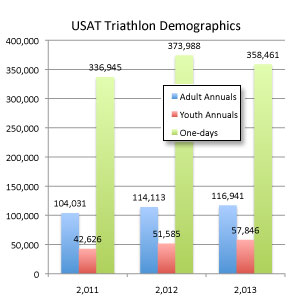

Let's talk numbers. Well rely on USA Triathlon's demographic data for some of this. USAT is capable of giving us stats for about 80 to 85 percent of the sport in the United States best in my rough estimate. The demo report published a year ago, for calendar 2012, contains some inaccuracies due to a change in the way USAT accounted for youth triathlon between 2011 and 2012, but I've been getting some help from chief marketing officer Chuck Menke and have new data both for 2012 and 2013 (at left).

USAT has about 175,000 annual members, up from 165,000 a year ago. The biggest increase is in youth. It's up 12 percent year over year. Adult annuals are up just a smidge, maybe 2 or 2.5 percent. As we see, 1-days were down slightly in 2013, and if we assume all of these are adult then the aggregate adult 1-day and annual total is down a bit, from roughly 490,000 to 475,000. As noted, this is largely offset by youth, but industry (e.g., manufacturers) probably feels the adult flattening more than the youth upsurge.

We – our sport, our industry – has a hard time generating numbers. If you go into a store and buy a floor pump, for your tri bike, that's not going to get tagged as a triathlon purchase. The entities that track sales and slot them into silos can't or at least don't track triathlon. You can't track it at the cash register. Active did a very nice job of tracking your purchase habits last year through a survey in which some reading this might have participated. But Active cannot, as of this time, tell me whether their registrations taken, year over year, are up, down or flat.

The Sports and Fitness Industry Association (SFIA, formerly the SGMA) reported that for 2010 triathlon participation was at 2.3 million and by that it meant someone "participating" in the sport at least twice. This was a widely quoted study and and this number (I did confirm) was specific to the U.S. The SFIA will produce another report later this week and it's expected to show a big increase from that 2.3 million number when it tells us how many people competed in 2 or more triathlons in the U.S. In 2013. No doubt this will be big news and I expect that USA Triathlon and everyone else industry-related will send out a press release trumpeting this, as happened when the last SFIA report came out.

Here's the problem: if USAT sanctions about 80 percent of the races in the U.S., and it sells 175,000 or so annual memberships, and 360,000 1-day memberships, and if all those 1-day members only race once a year, that's just over a half-million individuals racing per year and most of them are only racing once. If there are 100,000 racing outside of the federation umbrella, now we're at two-thirds of a million triathletes in the U.S. How do you get from there to something well north of 2.3 million?

The SFIA generates their data by surveying a random 20,000 respondents, asking them about their habits: tennis playing, bowling, archery, health clubs and so forth. Including triathlon. Then it scales up the number via a formula it uses and, voila, we've got a lot of people doing triathlons.

What I could believe is that there are 2.5 or 3 million people in the U.S. calling themselves triathletes but, like surfers, skiers, tennis players, we're now a lifestyle sport and we do these various activities – and we purchase bikes, tires, cycling bibs, sports massages and magazines – without actually racing. But this is not what the SFIA itself says it's asking. It seems not to recognize the lapsed or lifestyle or fitness triathlete, or the triathlete on sabbatical.

Therefore, either USA Triathlon has a much, much smaller segment of the U.S. triathlon population than they and I think it does (unlikely); or the SFIA's respondents have a much broader view of what a "triathlon" is than I do; or the SFIA's sample set is heavily skewed toward triathletes; or a lot of respondents are all saying "yes" to the question because they want to get counted as triathletes even though they did not race in the last year.

I suspect that latter option is mostly responsible for the gap between USAT's numbers and SFIA's numbers. Mind, the SFIA doesn't ask tennis players whether they played in a tournament twice last year. It gives swimmers the option to count themselves as either competitive or recreational – read: lifestyle – swimmers. It doesn't give triathletes any such option, rather, did you "participate" at least twice last year in triathlon. In my case, yes, I participated hundreds of times last year (every time I swam, bike and ran). But I didn't race last year. It could be that triathletes taking a hiatus from racing answered "yes" to the question posed because there is no lifestyle or fitness answer available to them.

This is why Active's data is so urgently needed. It's probably got a pretty stable customer base, so, its year-over-year numbers would be very telling.

The Pie Worldwide

What we know for sure is that triathlon's pie, worldwide, is booming. The "pie" is on a "roll." Just, the gaudy growth curves are not in the U.S. Venues in Europe that did draw 300 racers a handful of years ago are now drawing 900 or 1200 racers. Germany has always been strong in triathlon, but now it's also the UK, France and even countries like Italy, which has never really drawn large numbers. This is replicated around Europe. Triathlon in the UK is bursting at the seams, and Scandinavia and Finland are as well. What we see in Europe is just the filling out of that continent. Some countries just took longer than others.

The Challenge Family has races in the Philippines, Taiwan and Thailand along with 5 race weekends in Australia. Ironman hosts athletes 8 times in Australia for 70.3 racers and 4 full distance races. Ironman hosts athletes twice in Taiwan, an Ironman in the Spring, a 70.3 in the Autumn. That's very new, and would not have been thinkable a half-dozen years ago. Plus, Ironman's got two events in Malaysia and another in the Philippines. China hosts the ITU World Long Course Championship this year in Weihai, Beijing is the site of a large IMG triathlon, and these larger races are coming back to Japan as well.

Let's look at some numbers, and we'll start with our own. If you look back 4 years ago, our readership in the U.S. now is not so different than it was then. In "sessions" served we're up about 20 percent since 2010 in the U.S. and Canada. Not so elsewhere. In 2010 we had three times as many readers in Canada as in the UK. Today, we host about the same number of sessions to UK and Canadian readers. In the chart above, "Western Europe" are powerhouse triathlon markets, including Germany, France, Netherlands, Belgium, Switzerland, Austria. We serve today as many pages to readers in Southern Europe as we did in 2010 to Western Europe. Southern Europe on this chart is mostly Spain and Italy.

Again, for emphasis, during a 4-year time interval where Slowtwitch traffic grew in North America single digits per year over the last 4 years, our traffic in 2010 to triathlon powerhourse Germany – always our fifth largest "customer" in terms of readers – is today exceeded by our traffic to Sweden, and by New Zealand, and by the Netherlands, and readers in France.

Mind, we're not trying to toot our horns. We're only up 20 percent in our core North American market over the last 4 years, in sessions hosted. This is just to illustrate how much growth has occurred in the past 4 years in other parts of the world. Not only has the rest of Europe caught up to where Germany was 4 years ago, we host more sessions to Singapore today than we did to Germany 4 years ago. I'm also not saying that our reader metrics are representative of the world's triathlon demographics. I do find that if I use our reader metrics as a proxy for triathlon's growth worldwide, it seems to match nicely the efforts and interests of the two brands seeking to establish a worldwide triathlon network of first class races, and let's talk about those brands.

Challenge and Ironman

Ironman doesn't look for venues the way I do. I like to look for lakes with boat ramps in areas with controllable traffic. Ironman looks at density of customers per million. It looks at an area that ought to be popular with its customers and asks itself, "Why do we only have 80 registrants per million inhabitants? We ought to have 200." Or 400. Then it finds a venue. Or buys a race. It can do this, because I can't go to a CVB and make the case for why I should get the roads closed and use of the harbor and whatnot, because I'm going to bring in 3000 to 5000 out-of-towners who'll spend thus-and-so. Ironman can and does make that case and then delivers on its promise. It will find a venue, or make a venue, where you and I could not. Ironman isn't interested in how many triathlons there are in an area. It's interested in how many customers it has in an area. If you're going to be mad at Ironman for that, fine. But then don't shop at Costco either, and don't buy a latte at Starbucks. This is how business works.

Still, Ironman is figuring out through trial and error what its brand can command. If the race is too rural or too difficult triathletes will only travel so far, when there are so many options available. Conversely, the brand can shoehorn a race into a town only so big. It went into only to back out of New York City and Berlin. Chattanooga is Ironman-sized. Raleigh is Ironman-sized. Ironman is learning, city by city, race by race.

Challenge owns a brand premium in Europe because when I think of triathlon in Europe – when I just think, culturally, what races do I want to do personally – it's a Challenge race. I want to do Challenge Rimini, or Sardinia, or Mallorca, because I'm going to get the indigenous Euro experience at a Challenge event. Those who want to race in North America want experience what Graham Fraser built. Fraser is the architect of the Kona experience outside of Kona and Couer d'Alene, Florida, Lake Placid and what is now 70.3 Oceanside have the imprimatur of that man and his team. The current Ironman team, led by Steve Meckfessel, is often able to deliver that experience in venues and on courses that a typical race organization is probably not able to get.

If I'm right in my analysis of the premiums that each brand – Challenge and Ironman – offer, then the trick is for each brand to attract customers in the other brand's host continent. So far, Ironman is probably doing a better job in Europe than Challenge is doing in America, but Ironman has a big head start. The brands have been in a pitched battle in Australasia as well, and now that battle has expanded to every continent not covered by an ice cap.

Why are Challenge and Ironman racing around the world, looking for strongholds? Clearly, the big, double-digit growth in triathlon is outside the U.S. Our own reader patterns suggest this. I think you can see why all these Challenge and Ironman races are popping up in Europe, Asia, Australia, Africa and Latin America. North America is the largest worldwide triathlon market, but it's near the bottom in growth rate.

The Pie in the United States

As noted in the first installment of this series, triathlon in the U.S. is historically counter-cyclical with the rest of the world. We grow, other countries rest. They spurt, we rest. In North America (excluding Mexico) we're resting, if you call a flat adult market, and 12 percent youth growth, year over year, resting. Let's get back to demographics and metrics for a moment.

USAT's Marketing manager Chuck Menke reports that the younger you are the more of a chunk of triathlon's youth pie you represent. "The most populous age group over the past several years has consistently been 9-10 year olds with an average of 26 percent of under-20 participants, followed by 11-12 year olds at roughly 21 percent. The 16-19 year olds group represents 12 percent of the youth market.

How large is this youth sector, if you say that everybody under 20 years old is youth? It's about a third of the entire USAT membership, and this is not unlike the rise of women – as a percentage of the pie – in triathlon in the last decade.

We are now about 40 percent female whereas in the first triathlon run-up, in the 1980s, females never cracked the 20 percent mark. Youth is undergoing a similar growth spurt. USAT has a lot going on in the youth area, both in coaching initiatives and in events (such as 50 Splash & Dash Youth Aquathlon Series races). Is this driving youth triathlon? Are the Olympics driving it? I don't know. My guess, adults entering triathlon are not driven or motivated by the Olympics, but youth is.

The average age of triathletes in the U.S. is 38 and the most populous age groups are 30 to 44 and it's been that way for a couple of decades. But Slowtwitcher Dev Paul has gone back and looked at race results and found that the most populous age groups in a number of North American Ironman races has crept up over the past decade, so, maybe it's the youth upsurge that has kept our average age at 38. Probably we're slightly, very slowly, gentrifying as a sport if you look at adult triathlon.

In fact, since the growth of triathlon over the past 4 or 5 years has come so much from women and youth, those in industry (RDs, manufacturers, retailers) who sense or feel that triathlon is flat in North America are probably reacting to the fact that the growth is coming from areas that atypical of their usual customers. They still have 35 and 45 year old white men buying goods and services, but in no greater numbers (and maybe in fewer numbers, because of increased competition in every category of good or service). The growth in triathlon is coming from women, youth, and those in other continents, none of which spend as much as do middle-aged white men living in their home regions.

How Tasty is our Pie?

Triathlon got really popular in the U.S. during the 2000s. A lot of people took notice. Big bike companies. Internet companies. Including Amazon. Ironman, Challenge, Rev3, IMG, and others came into the sport. When I built the first triathlon wetsuit company from the ground up in the 1980s I was the only one selling triathletes wetsuits. Once competitors sprung up it was still just a handful of companies, fewer than 5. Now? Dozens. In short, the number of people in industry trying to get a piece of the pie grew faster, over the last 5 or 6 years, than the pie grew. Accordingly, most people trying to get their fair shot at that pie found that their allotted slice was no bigger and in some respects maybe smaller.

When I talk to those in manufacturing what I hear is that the business is down. It's flat or down, or maybe low single-digit upticks. Why? Because those who're reporting up numbers are new to the market and they're taking a bite out of existing players. It's that same way in retail and in race production.

Who's growing? Ironman. Why? I think it's because the spendy part of the market – white collar men and women between 30 and 50 – are a stable population of athletes both in their careers and their understanding of and attachment to the sport. They understand what Ironman is and gravitate toward that brand. I don't know how many new athletes in this cohort we're making. We used to gain 35 year old professionals much faster than we lost them. Now I think we're gaining them at about the same rate we're losing them. We're gaining kids much faster than we're losing them, and the rest of the world – outside North America – is welcoming those 35 year old professionals in droves. Here in the U.S. that prime demographic that makes a decision to get up off the couch and do something might gravitate toward triathlon, but he or she might also decide that a mud or color run sounds better. Or a mountain bike race.

I asked 156 race directors about their numbers in 2013, and asked about their Olympic distance and shorter triathlons. They told me that they were level (28 percent), down (36 percent) or up (30 percent) in those percentages. But in half-distance races these same RDs reported that they were more up than down. To me, this indicates a slight gentrifying of the market. But here's the interesting thing. About 60 percent of these RDs produce footraces as well, and 3 times as many of these same RDs reported up numbers than down for their footraces. To me, all this indicates that newbies are entering footraces instead of getting off the sofa and marching straight into a triathlon. (This has happened in triathlon before.)

Triathlon's race directors who do struggle are not blaming Ironman. To the degree they're having trouble, they say it's the new RD coming into the market and putting on the same kinds of races, or it's difficulty getting the courses they want at a reasonable cost from the local municipality or county. Or they say it's the distraction of other kinds of events, like mud runs.

Who are all these new people wanting a slice of this Pie?

In my history on the business, I've seen a lot of companies dive in and out of triathlon. Most notoriously are the footwear companies. In the 1980s Nike was a big sponsor, and Mark Allen, Liz Downing, Kenny Souza, Joanne Ernst, were all Nike athletes. More recently the Simons, Lessing and Whitfield were a Nike athletes. Nowadays? Helle Frederiksen, some others, but Nike is not a major sponsor inside of triathlon. Same with Reebok. Its athletes were Greg Welch, Michellie Jones, and a host of others back in the late 80s and early 90s. Companies like Reebok had big budgets for triathlon. But its interest ebbed and flowed as did triathlon. Trek and Specialized have historically behaved likewise, and over the past year, as triathlon has flattened in the U.S., the Specialized's budget for tri sponsorship have tightened.

This phenomenon seems true for every category of industry in triathlon. Race organizers, footwear makers, apparel companies, retailers, bike manufacturers, helmet companies, and for that matter insurance companies and everybody else all see these attractive growth markets and jump in. The chart above is not drawn to be accurate, rather to illustrate a point. Companies non-endemic to triathlon have interest in triathlon that ebbs and flows as triathlon cycles. The blue area represents companies like Cervelo, De Soto, XLAB, All3Sports, Newton, Fuel Belt, Zoot, Inside Out Sports, HED, Zipp, Ironman, Challenge, Triathlete and Lava Magazines, USA Triathlon, and so on. The rust color represents companies that do not make their living primarily in triathlon, but scale up and down when triathlon scales is in a growth mode versus a flat period.

The problem occurs when the non-endemics are late to the upsurge, and late to understand when a flattening occurs. Whether it's races produced, containers of bikes manufactured, too much apparel sitting on shelves, too much product ordered by too many retailers for whom triathlon is not a core business. This makes triathlon feel down to an endemic industry player even when it's not down.

What is the future of this Pie?

When I poll RDs I hear several things from them. The athletes, they say, will travel a bit to do an Ironman or 70.3, otherwise they'll go to the closest race available. Races suffer because the radius of athletes that used to scribe their audience has shrunk. The well-produced independent race is not drawing from a customer area as large as was previously the case, because there are other races in that circle of customers that did not exist 5 or 6 years ago.

Further, these RDs say the increase in everything from a 5k to a Spartan Run to a mud run to a color run, or a Rock ‘n' Roll marathon or half-marathon is tugging at the attention of the first-timer.

Those putting on not youth triathlons, but kids triathlons, say USAT's decision to raise the 1-day fee from $5 to $10 (or an annual $15) is a killer if you're putting on races for kids under 12. The way one RD put it: "USAT is by biggest competitor. My youth races are down by 50 percent since the USAT increased the youth membership fee." USAT might point to the growth in the youth sector as evidence that its fee hike is not hurting kids races, but I have not gotten any data yet on these under-10 year old events.

This is at odds, however, with USAT's experience. My guess is that youth is up nicely if you're not talking about "kids" triathlons.

One comment I heard from RDs, when I ask where you're hurting, is "I'm not hurting." Here's the way one RD put it to me: "I think there is a weeding out process going on. Top events continue to do well and sub par events are suffering. In other words the cream is rising to the top." Still, this is a minority position. I asked these 156 RDs why their businesses are hurting, and only a third of them answered, "My business is not hurting."

This is not the same as saying that two-thirds of triathlons are hurting. The races that are not hurting are often the larger races. My poll of 156 event organizers was 1-company 1-vote. Ironman's business is not hurting. If you march around the country and you look at HITS, TriRock, Life Time, Rev3, Challenge, most of these companies are growing, each race, year over year, with new races incepted.

In my opinion, we've seen 3 running booms, starting with the 70s-era with Frank Shorter, Bill Rodgers, Amby Burfoot and Jeff Galloway. We had the mid-90s boom, and finally the post-Born to Run era beginning in 2010. Triathlon benefited from the first 2 of these running booms. People seem to gravitate to triathlon after they got off the couch and into a 5k and then wanted an additional challenge. Just, the benefit of these booms to triathlon was latent. Those putting on 5k events got people ready for triathlon, but it was some time – 2, 3, or 5 years – before those newly active folks wanted to take a next step into multisport. Will this latest running boom propel triathlon in the U.S. Into its third surge, just like before? We'll see.

Running did not go away in between its booms, neither did triathlon between its booms. Nor did cycling between its booms. There just seems to have been a rise followed by a plateau or flatter growth curve for each of these activities between their booms. When we see a renewed steepening of the growth curve in triathlon among adults? My guess, sometime between 2014 and 2017. Is it going to be 2017? I don't know. One of my health-of-triathlon bellweathers is the 32 year old L.A. Triathlon Series, Bill Fulton's races outside of Los Angeles on which a lot of us cut our teeth in the 1980s. They held their first race of the season 3 weeks ago. I looked at the results, and they had a 22 percent jump in finishers year over year. You never know. Triathlon's third North American surge might already be percolating.