1996 Kona Bike Survey

As many Slowtwitchers know, the Survey began in 1992, by me, during the time I owned and ran the company I founded in 1987, Quintana Roo. I produced this Survey until the end of my QR days in 1999, and continued the Survey through 2006 as a Slowtwitch feature.

Over a 2-week period I'll be reproducing these Surveys precisely as they were written, with the exact graphs published at the time. The only difference will be prefaces like these.

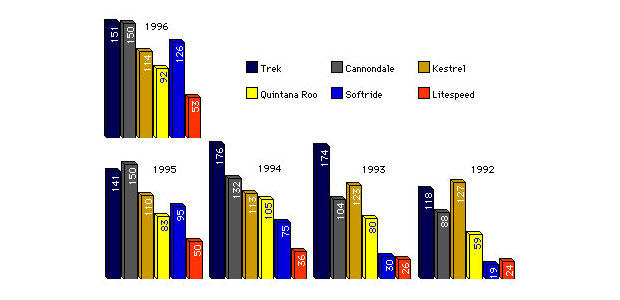

This 1996 Survey shows the bike count by brand back to 1992, the first year of the Kona Bike Survey. It's on the bottom graph. -DE

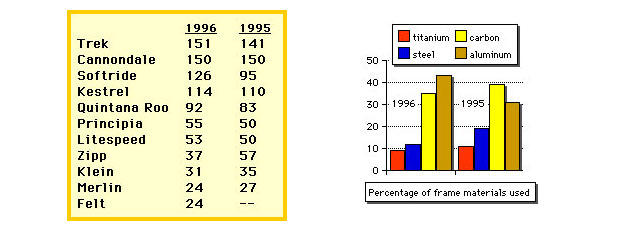

Cannondale briefly outdueled Trek in last year's race, but Trek reclaimed the top spot by one bike in this year's event. Softride continued to gain ground, and although Zipp was a decliner, and Specialized was worse, dropping from 36 bikes to 16, Vitus took the biggest percentage fall, with 9 bikes to last year's 24. Beams in general seemed to decline other than in Softride's case. The total number of beams is the same or slightly increasing, and Softride makes the clear favorite among Ironman competitors in this category.

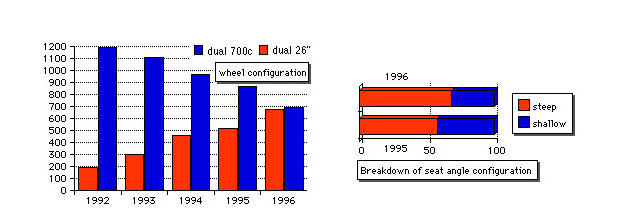

Last year's trends continue. One year ago 38 percent of all bikes in the Ironman had dual 26" wheels, now it's virtually a dead heat. Use of a seat angle at or steeper than 77 degrees increased from 58 to 68 percent. The biggest turnaround, however, was apparent in frame materials. Last year carbon outperformed aluminum 39 to 31 percent, this year aluminum bikes made up 43 percent of the bikes to carbon's 35 percent.

There were 20 percent fewer titanium bikes than the year before, and a third fewer steel bikes (we don't see how steel bikes can fall below 12 percent, it is too good a frame material for that). Sixteen percent more riders used a saddle cover than last year, 78 percent were QR saddle covers, as opposed to 79 percent last year.

Unless trends change dramatically and immediately, next year the "triathlon bike", as defined by a steep seat angle and 26" wheels front and rear, will be the dominant bike at Hawaii, and the standard road bike will be in the minority. Interestingly, Trek is both the Number-1 bike in the race, and the champion of a variety of ideas which are in decline, with regard to wheel size, geometry, and frame material.

It is not statistically possible for Trek to maintain its top advantage without either changing its mind about what a tri bike is, or changing the minds of its potential customers. Its job will be made that much more difficult by the fact that at the Hawi turnaround on the bike course, 14 of the top 15 pro riders were riding dual 26", steep-seat-angle bikes.

When we first started our survey in 1992, there were 160 different manufacturers represented in the race. Now there are many fewer, and the top five manufacturers represent about 50 percent more in total bikes than the top five did in 1992. At this year's Interbike about 40 companies showed a triathlon bike, more than any before. And yet most of these newcomers are probably too late (obviously we are biased, and we HOPE they're too late!). If the Ironman is any gauge the market has already winnowed down to a number of significant players. The companies who have paid attention to the market have doubled and tripled their numbers, while some of the others have lost up to eighty and ninety percent of their representation.