The More You Know: You Can Now Use HSA or FSA Dollars to Buy Your Next Bike

If you’re part of the roughly 20% of Americans who have either a health savings account (HSA) or flexible savings account (FSA), it may come as a surprise that you can use those dollars to fund your next triathlon-related purchase.

Bike brands like Quintana Roo and A2 Bikes have partnered with Truemed to support online checkout and utilization of tax-free dollars from these respective HSAs and FSAs towards the purchase of bikes.

Most triathletes will be more familiar with FSAs versus HSAs. FSAs are offered as an additional benefit through employer-based health care plans. Individuals can contribute up to $3,300 of pre-tax income to the plans to spend on qualified medical expenses. HSAs, meanwhile, are offered in conjunction with high-deductible health plans (HDHPs). Those plans feature deductibles of at least $1,650 per individual or $3,300 per family, with maximum out-of-pocket costs of $8,300 per individual or $16,600 per family. HSAs are capped at $4,300 per individual or $8,550 per family.

The process is somewhat straight forward. Let’s say you wanted to buy a new Quintana Roo, and you opted for the X-PR, which starts at $4,179 before you start adding items via their best-in-class configuration tool. The bike that I would build up from them, which features a premium paint scheme, an upgrade to electronic shifting, and ENVE’s Foundation series 65mm wheels, would set me back $7,700.

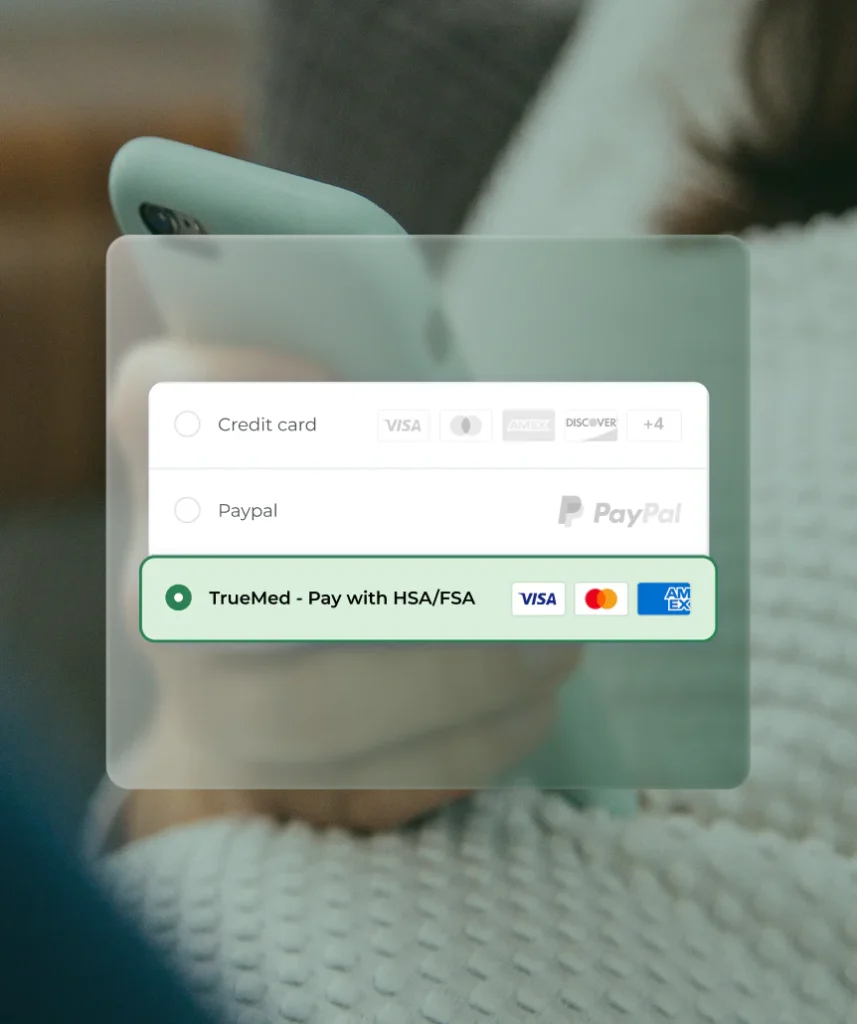

Once you’ve finished the configurator, you head to checkout. You then hit Truemed as your payment option to then be re-directed to their website.

You’ll complete a brief health survey. That survey is reviewed by a licensed practitioner. You then checkout using your HSA or FSA card. If you do not have enough funds within that HSA or FSA (which is likely, given those maximum contribution limits mentioned above), you can then split payment across your HSA/FSA card and a typical credit or debit card.

It’s simple — and a way to use pre-tax dollars to help your procure new gear. According to Truemed, by using pre-tax dollars, it increases your purchasing power by approximately 30%.

In addition to Quintana Roo and A2, other major brands participating in the space include Canyon, Wahoo Fitness, Zwift, Peloton, and Tonal. For some of these brands, instead of being able to directly use an HSA or FSA card, you’ll apply for reimbursement after the fact. You can find all of the brands that participate in Truemed here.

Tags:

A2 BikesCanyonFSAQuintana RooWahoo FitnessContinue the discussion at forum.slowtwitch.com

13 more replies

This is great information.

Just note that despite the nice screenshot, (at least for Canyon, I didn’t check other bikes) it is not directly billing your FSA/HSA. You pay for the bike normally and then submit reimbursement from your FSA/HSA. These guys will give you a letter after you do the survey that confirms that buying more bikes is good for your health. Not sure if the FSA/HSA will automatically accept it.

So, it depends – certain brands you can directly use your HSA/FSA card for authorization. Others use the reimbursement method.

Example: know that A2 Bikes is a reimbursement process. QR is direct bill.

Thanks Ryan. I corrected my post, I only tested with Canyon.

I updated the story for clarity.

I wish they would increase the max amount we can put into our FSA accounts. Every year I max it out at $3,200, but I use it for the kid’s expenses like dental, vision, etc.

I’d be great if we could put another $4K for a good bike

Very cool. Are these the only two brands this works for at the moment?

With an HSA the best financial option is to get an LMN from your GP, pay out of pocket and save both thet and your receipt. Then instead of pulling out the funds leave them invested in a market tracking EFT (examples VOO, QQQ) and then when you retire and need some cash submit your LMN and receipt. In retirement the HSA distribution won’t go towards taxable income and will have earned significant interest. I assume if you have 7k in your HSA for a new QR you also likely have that as disposable income in your high yield savings account.

FSA go to town it’s use it or lose it anyway.

QR is not showing up on the Truemed site for whatever reason

Yeah this. I used to use my HSA for medical expenses but recently started paying out of pocket for everything and investing my HSA in low cost index funds/ETF’s. Collecting receipts is annoying but it’s worth it in the end when you have a couple hundred grand in tax free money at 60.

No thanks, I’m saving my HSA money to fund my knee and hip replacements in retirement

You go directly through QR’s purchase flow.

No idea on that, but I think Wahoo and Zwift have similar setups for trainers.

Last paragraph of the article has you covered.

Oh my goodness, this is great information and I had no idea. But I also kind of wish I didn’t know because now my HSA is in serious danger. I mean, with 30% more purchasing power, I kind of have to buy a new bike, don’t I?

QR and Canyon are D2C brands. I believe A2 is as well, but not positive. Will be interesting to see if prices go up with this.